2023 Report Volume 2

Our 2023 Report – Volume 2 provides legislators and the public critical information on whether the Government issued reliable financial statements, used effective processes to administer programs and services, and complied with governing authorities. It includes the results of examinations of different agencies completed by November 3, 2023, with details on annual integrated and performance audits, as well as our follow-up audit work on previously issued recommendations by our Office and agreed to by the Standing Committee on Public Accounts or Standing Committee on Crown and Central Agencies.

Annual Financial Audits' Highlights

Since our last Report (2023 Report – Volume 1), our Office, along with appointed auditors (if in place), completed annual integrated audits of 179 different agencies with fiscal year-ends between January and June 2023. These include integrated audits of 19 ministries, 116 Crown corporations and agencies, 8 pension and employee benefit plans, and 36 healthcare affiliates. This section includes concerns at 10 agencies, which means most agencies had effective financial-related controls, complied with financial and governance-related legislative authorities, and prepared reliable financial statements.

There are a few agencies lacking adequate review and approval of financial information, such as bank reconciliations and journal entries, which increases the risk of errors in financial information and misappropriation of public funds. As a result, these agencies are also experiencing difficulties in preparing adequate financial statements for audit. We found these concerns at the Western Development Museum (Chapter 10), Prairie Agricultural Machinery Institute (Chapter 7), and Government Relations’ Northern Municipal Trust Account (Chapter 3).

In March 2023, the Ministry of Highways (Chapter 5) incorrectly paid more than $500,000 to an individual impersonating one of the Ministry’s suppliers. It later recovered about $400,000. In response to this incident, the Ministry changed its processes in August 2023 to require a second individual to verify and authorize any requested changes to supplier banking information. The Ministry of Highways follows the Ministry of Finance’s guidance for maintaining and changing supplier information. Highways needs to work with Finance in strengthening their guidance to all ministries for verifying changes to supplier information, which will minimize the likelihood of other ministries making inappropriate payments to illegitimate suppliers.

One of the primary benefits of having robust financial and IT controls is that they support government agencies in maintaining accurate records while also preventing losses due to errors or fraud.

eHealth Saskatchewan (Chapter 1) has to sufficiently test its recovery plans to ensure it can restore critical IT systems it manages for the health sector when a disaster occurs. As ransomware and cyberattacks steadily increase, IT service providers like eHealth need tested disaster recovery plans to enable speedy and easy recovery of key systems and data from the point of attack. Disaster recovery plans must work when needed to help to minimize consequences when a disaster occurs and resume business as soon as possible. This is especially important in the health sector where an IT failure can endanger patient health.

The Saskatchewan Health Authority (Chapter 8) spent nearly $157 million by March 31, 2023, on its business-wide IT transformation project (AIMS) originally expected to cost $86 million to implement by March 2021. By March 2023, the Authority still has neither implemented this IT system nor established a new AIMS implementation date following a paused attempt to “go live” in November 2022. It will be important for the Authority to coordinate and share a formal lessons learned report with other government agencies once the IT project is complete to help avoid IT system implementation failures on similar projects in government. At March 2023, the Ministry of Health and the Authority forecasted $240 million total cost to get the IT system implemented. By not learning from project failures, government agencies can be destined to repeat similar situations and incur significant cost overruns.

Performance Audits

Performance audits take a more in-depth look at processes related to the management of public resources or compliance with legislative authorities. Performance audits span various topics and government sectors. In selecting which areas to audit, we attempt to identify topics with the greatest financial, social, health, or environmental impact on Saskatchewan. Three highlighted performance audits 'At a Glance' are as follows:

Chapter 12 'At a Glance' Ministry of Agriculture—Conserving Agricultural Crown Land

Chapter 14 'At a Glance' Ministry of Health—Coordinating Timely Neurosurgery Services

Follow-Up Audits

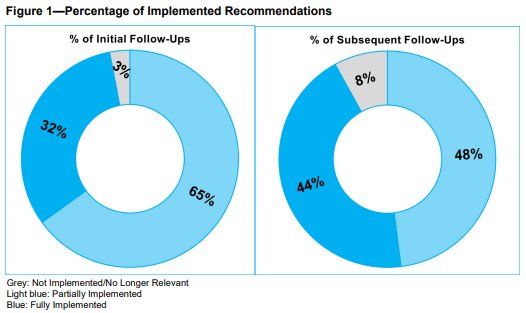

As shown in Figure 1, 32% of the audit recommendations in this Report were fully implemented after the initial follow up (i.e., 2–3 years after original audit) at the various agencies. For agencies with subsequent follow-ups (i.e., >3 years after original audit) in this Report, 44% of audit recommendations have been fully implemented. This is well below our previous Report (2023 Report – Volume 1) where the rate overall was 62%.

Some agencies like the Coroners Service (Chapter 22) succeeded in making the majority of necessary process improvements in a relatively short period, while other agencies take more than five years. There were only three out of nine agencies that fully implemented recommendations after our most recent subsequent follow-up (our second or third follow-ups).

By July 2023, the Saskatchewan Health Authority (Chapter 25) had made little progress on addressing the recommendations we first made in 2017 about overseeing contracted special-care homes. The Saskatchewan Health Authority contracts with private-sector operators for 15 special-care homes in Saskatoon and surrounding area. Special-care homes continue to not meet established performance measures and service expectations related to quality of care. For example, the number of residents on antipsychotic drugs without a diagnosis has not met expectations. This is often an indicator that special-care home staff chemically manage their residents. Not taking timely actions to address non-compliance can negatively impact special-care home residents’ quality of life.

Sick leave also continues to increase at the Saskatchewan Health Authority (Chapter 24), with actual sick time reaching about 13.4 sick days per employee in 2022–23. The Authority neither monitors actions taken by managers to work with those employees with excessive absenteeism nor sufficiently analyzes and identifies strategies to address employee absenteeism. Excessive employee absenteeism can impact employee well-being, costs, and quality of health services delivered to the public.

Media Materials 2023 Report – Volume 2

- News Release 2023 Report – Volume 2: Coordinating the Provision of Timely Neurosurgery Services

- News Release 2023 Report – Volume 2: Conserving Agricultural Crown Land

- 2023 Report – Volume 2: Backgrounder

- Compilation of Main Points/Executive Summary

- Download the Full 2023 V2 Report

(For selective viewing please click on an individual chapter from the list below)

Provincial Auditor of Saskatchewan's Overview

Tara Clemett's Complete Overview 2023 Report – Volume 2

Our Office’s mission to promote accountability and better management of public resources, while preserving our independence, provides legislators and the public with an independent assessment of the Government’s use of public resources. We do this through our audit work and publicly reported results, along with our mutual involvement with legislative committees charged with reviewing our Reports.

Table of Contents

2023 Report – Volume 2 Table of Contents

Annual Integrated Audits

3 Government Relations—Northern Municipal Trust Account

5 Highways

7 Prairie Agricultural Machinery Institute

8 Saskatchewan Health Authority

11 Summary of Implemented Recommendations

Performance Audits

12 Agriculture—Conserving Agricultural Crown Land

13 eHealth Saskatchewan—Maintaining Key Healthcare IT Servers

14 Health—Coordinating the Provision of Timely Neurosurgery Services

Follow-Up Audits

16 Advanced Education—Working with the Advanced Education Sector to Achieve Ministry Strategies

17 Agriculture—Mitigating Pests in Crops and Pastures

18 Education—Evaluating the Early Learning Intensive Support Program

19 Environment—Regulating Waste Diversion through Recycling

20 Health—Monitoring Enforcement of Tobacco and Vapour Products’ Legislative Requirements

21 Health—Providing Special Needs Equipment for Persons with Disabilities

22 Justice and Attorney General—Conducting Timely and Accurate Coroners' Investigations

23 Saskatchewan Cancer Agency—Delivering the Screening Program for Colorectal Cancer

24 Saskatchewan Health Authority—Minimizing Employee Absenteeism in Kindersley and Surrounding Areas

27 Saskatchewan Public Safety Agency—Alerting the Public about Imminently Dangerous Events

28 Saskatchewan Public Safety Agency—Detecting Wildfires

29 Social Services—Investigating Allegations of Child Abuse and Neglect

30 Technical Safety Authority of Saskatchewan—Inspecting Elevating Devices

Standing Committees

31 Standing Committee on Crown and Central Agencies

32 Standing Committee on Public Accounts

Appendices

1-1 Agencies Subject to Examination under The Provincial Auditor Act and Status of Audits

2-1 Report on the Financial Statements of Agencies Audited by Appointed Auditors

All Prior Reports

All prior reports are available here for your reference.

Acknowledgments

Our Office continuously values the cooperation from the staff and management of government agencies, along with their appointed auditors, in the completion of the work included in this Report. We are grateful to the many experts who shared their knowledge and advice during the course of our work.

We also appreciate the ongoing support of the all-party Standing Committees on Public Accounts and on Crown and Central Agencies, and acknowledge their commitment in helping to hold the Government to account. Our Office remains focused on serving the Legislative Assembly and the people of Saskatchewan.

As Provincial Auditor, I am honoured to lead the Office, and our team of professionals. I am truly proud of their diligence and commitment to quality work. Our team’s steadfast professionalism helps us fulfill our mission—to promote accountability and better management by providing legislators and Saskatchewan residents with an independent assessment of the Government’s use of public resources.