April 30, 2013

April 30, 2013

Q. Financial budgeting vs. financial reporting – what is the difference?

A budget is a financial plan – a description of what the Government intends to spend and borrow, and the money it anticipates bringing in as revenue going forward; it is about the future. A financial report (financial statement) is about results – it is a look back at how the Government actually spent its money, how much it borrowed, and how much money it actually brought in as revenue.

In Saskatchewan, the Government has two budgets – the Summary Budget, and the General Revenue Fund (GRF) Budget. It also has two sets of financial statements that it uses to report its spending – the Summary Financial Statements, and the GRF Financial Statements. The Government reports publicly on both budgets and both financial statements but emphasizes different budgets and statements at different times, which is confusing and misleading to the public.

Q. What is the difference between the Summary Financial Statements (Summaries) and the GRF Financial Statements?

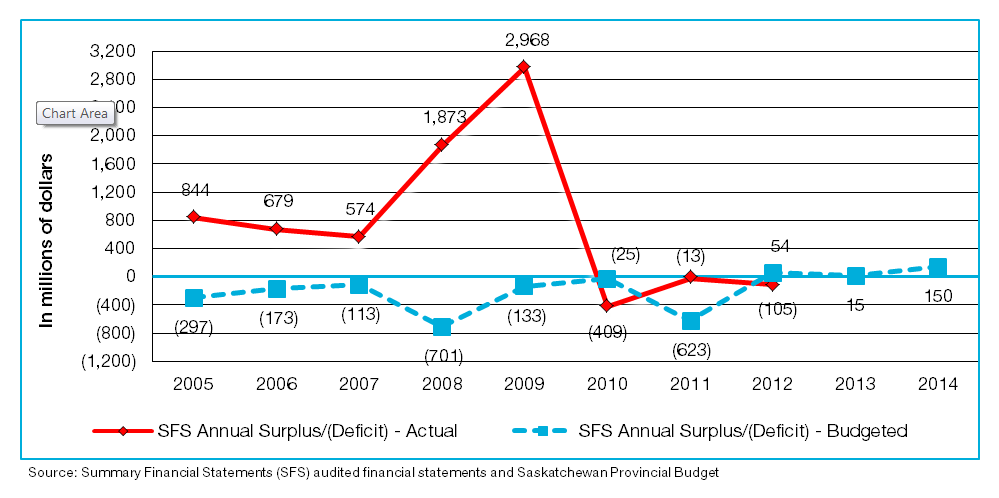

Essentially, the Summaries illustrate the financial activities of the entire government, including Crown corporations and other agencies. Figure 1 below shows the budgeted and actual results of the Summaries for the last eight years. The GRF, on the other hand, provides financial information about only a portion of the Government’s financial activities, leaving out the Crown corporations and other agencies.

Figure 1 – Actual and Budgeted Summary Information

Eight-year Comparison of Summaries Actual and Budgeted Annual Surplus (Deficit)

Q. Why are the Summaries better than the GRF?

When reporting publicly about its finances, the Government should use only the Summaries because they provide a complete financial picture about the Government. For this reason, they are the only set of financial statements that should be used when comparing the financial position of Saskatchewan to other provinces, or to the Federal Government. The same cannot be said for the GRF - it is neither complete, nor accurate.

Q. What are the problems with the GRF?

The GRF contains significant errors, which is one of the reasons why we continue to recommend that the Government stop using it when reporting publicly about its finances. The GRF does not include more than 270 Crown corporations and other agencies controlled by the Government, and can be altered to portray whatever financial picture the Government would like. This can be done in two ways:

- By controlling the amount and timing of money transfers to and from Crown corporations and other agencies, and

- By transferring money to or from the “rainy day fund”

In both cases, the transfers are recorded as “revenues” in the GRF, even though they are not really income – they are simply the movement of money from one government agency to another. Because the Government has full control over these transfers, it can change the financial results of the GRF to appear how it would like; for example, it can present a “balanced” GRF budget by strategically altering the amount and timing of transfers. The GRF also omits pension-related debt, which remains a significant portion of the Government’s total debt at $6.3 billion, or 43% (as of March 31, 2012).

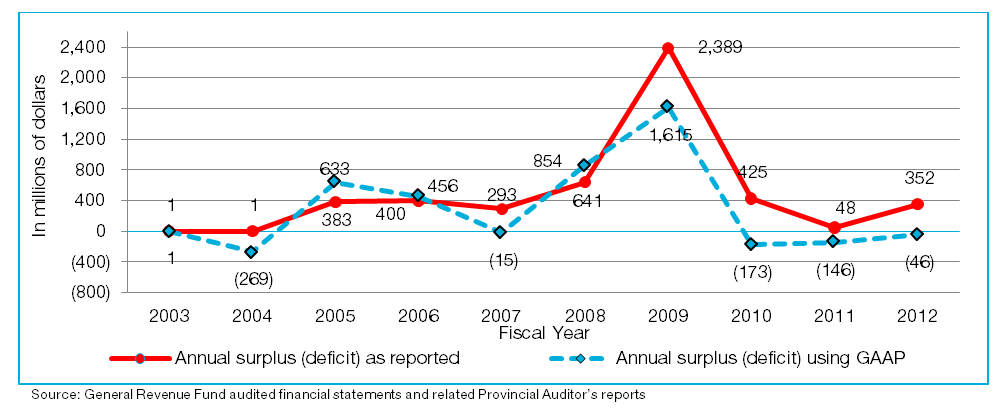

Another problem with the GRF is that the Government does not prepare the statements using Canadian Generally Accepted Accounting Principles (GAAP) – a set of standards, conventions, rules, and ethical guidelines that help ensure accountability and accuracy in financial reporting. When GAAP is not used, the financial statements can lack objectivity and reliability. A good illustration of this is shown in Figure 2. In Figure 2, we see that in 5 of the last 10 years, the Saskatchewan Government has reported annual surpluses in its GRF financial statements when it should have been reporting annual deficits under GAAP.

Figure 2 - Incorrect Reporting of Annual Surpluses

GRF Financial Statements - Annual Surplus as Reported Compared to What Should Have Been Reported

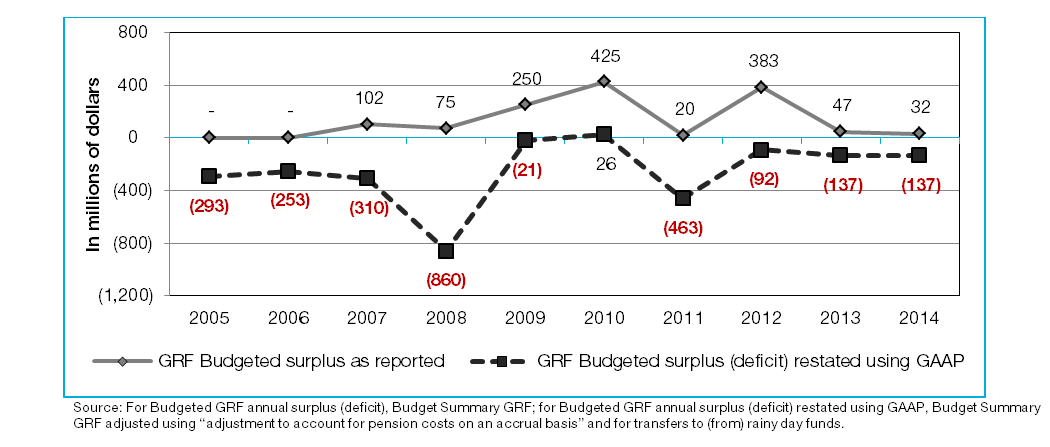

Similarly, Figure 3 shows that if the Saskatchewan Government had prepared its GRF budgets using GAAP, it would have presented deficit budgets in 9 out of the last 10 years instead of “balanced budgets”. In order to provide the people of Saskatchewan with an accurate picture of Government budgeting, the Summary Budget is the correct budget to use.

Figure 3 – Budget Not Actually “Balanced” for Last 9 of 10 Years

GRF Budgeted Annual Surplus (Deficit) as Reported Compared to GRF Budget Calculated Using GAAP

Q. Is the Government’s budget actually “balanced”?

It depends on which budget is being referred to – the GRF Budget, or the Summary Budget. Saskatchewan legislation only requires the Government to balance the GRF budget using “special accounting rules”.

The answer to this question also depends largely on the type of accounting used, as illustrated by Figures 2 and 3. As mentioned previously, when the Government prepares its GRF budget and financial statements, it doesn’t use GAAP. The Government should be using these accounting principles, as they are a safeguard to ensure accountability and accurate financial reporting. Had the Government used GAAP in preparing its budgets, it would have actually presented deficit budgets instead of “balanced budgets” in 9 out of the last 10 years.

Q. What is Saskatchewan’s total provincial debt?

The Government often refers to managing “general government” debt. However, it is important to note that general government debt is only a portion of the Government’s gross (or total) debt. Taking into account all components of the Government’s debt including general government debt, as of March 31, 2012, the Government of Saskatchewan’s total provincial debt was $17.4 billion. The total projected debt for March 31, 2014 is budgeted to reach $19.1 billion; general government debt makes up $4.9 billion of this amount.

Q. How much pension debt is included in the total projected debt of $19.1 billion?

Pension debt means that the amount of money that needs to be paid out for pensions is more than the amount of money available to fund them. By 2014, pension debt is expected to grow to $7 billion, or 37% of the Government’s total debt.

Q. What is “net debt”?

Net debt refers to the affordability of future government services. Net debt for Saskatchewan has started

to increase slightly over the last three years.

Q. What is “net debt to GDP”?

Net debt to GDP compares a government’s net debt to the state of the economy and provides insight into the degree to which a government can maintain existing service commitments and meet its existing financial obligations without increasing debt or taxes. In Saskatchewan, after a significant decrease, the last three years have shown some reversal of the previous downward trend. Having said this, the Government is better able to afford its debt today than it could eight years ago.

Q. How do Saskatchewan’s financial reporting practices compare to those of other provinces?

All Canadian provinces have funds similar to the GRF; however, all of them – including the Federal Government – use only the Summaries as the focus of public financial reporting. The use of Summaries has become “standard” because they capture the financial results of all Government agencies. The Summaries also cannot be altered to achieve a desired financial picture, and include pension debt. Interestingly, Saskatchewan was one of the first provinces to prepare Summary Financial Statements

yet, as of 2013, it would be the last to use them as the primary public reporting tool in communicating financial results to its citizens.

Q. How does Saskatchewan’s use of public GRF reporting impact the comparison of its financial performance against the rest of Canada?

In order to accurately assess Saskatchewan’s financial performance against that of other provinces, it is essential to compare apples to apples and not apples to oranges. In other words, since most provinces publicly report on their Summaries, Saskatchewan should be doing the same. Comparing Saskatchewan’s GRF budget to the Summary budgets of all other provinces is not only inaccurate, but also very misleading. As well, although each province may include different agencies within their Summary statements, what matters most is that they include all agencies controlled by government. The pervasiveness and impact of this misinformation is evidenced by the fact that the C.D. Howe Institute, the Globe and Mail, and Macleans have each mistakenly compared financial information from Saskatchewan’s GRF to other provinces’ Summary financial information. This confusion could have been prevented if the Saskatchewan Government publicly reported on only its Summaries instead of the GRF, like all other Canadian provinces.

Q. What is the problem with the C.D. Howe Institute report?

The C.D. Howe Institute’s February 2013 report illustrates the confusion and inaccurate information that results from the Saskatchewan Government’s use of “two sets of books”. Without overtly stating so, the C.D. Howe Institute graded the financial reporting of Saskatchewan based on its GRF information as opposed to its Summary information – essentially, it inadvertently compared apples to oranges because the Summary information was used for all other provinces. Because most provinces prepare quarterly interim budget reports on a Summary basis, the Institute assumed that Saskatchewan does as well, but

it does not. This mistake would have been avoided if the Saskatchewan Government publicly reported on only one set of books – the Summaries. The C.D. Howe Institute has since acknowledged the error and has indicated that they plan to use the Summary financial information from all provinces going forward.

Q. What is the problem with the Globe and Mail’s articles?

The Globe and Mail’s articles are another example of public confusion and inaccurate information that results from the Saskatchewan Government’s financial reporting practices. In a February 2013 article, the publication mistakenly compared Saskatchewan’s GRF information to the Summary information of all other provinces. In a subsequent article, it also praised Saskatchewan’s financial management quoting the GRF numbers. The Globe and Mail later issued a follow-up article that assigned Saskatchewan a letter grade of C-minus for its fiscal reporting, based on the correct data. As with the C.D. Howe Institute, this confusion could have been avoided if the Saskatchewan Government publicly reported on only the Summaries.

Q. Isn’t more information (presenting both the Summaries and the GRF) better?

No, in this case, it’s not. As we have seen, using two sets of financial statements – two sets of books – can be misleading and confusing to the public, as many individuals may not necessarily be aware that they are only hearing part of the financial story. The public is then left to try to discern which quoted numbers actually reflect the true state of Government finances. Using only the Summaries would alleviate this confusion and would make the Saskatchewan Government more transparent by providing

the people of Saskatchewan with a full, fair, clear financial picture.

For more Information:

The Provincial Auditor’s full special report The Need to Change – Modernizing Government Budgeting and Financial Reporting in Saskatchewan is available online at www.auditor.sk.ca.

Contact:

Ms Bonnie Lysyk, MBA, CA

Provincial Auditor Saskatchewan

1500-1920 Broad Street

Regina, Saskatchewan S4P 3V2

Telephone: (306) 787-6398

Fax: (306) 787-6383

2013 Special Report: Frequently Asked Questions: Government Budgeting and Financial Reporting (PDF)